International Trade- know your incoterms.

If you are an international importer or exporter, you need to know the word “INCOTERMS." If you are new, then we will discuss everything for you. You will get an explicit knowledge of incoterms. They address who’s responsible for making payments on and monitoring shipments, obtaining insurance, preparing shipping and customs documents, and other shipping-related tasks. They’re industry-standard, so they’re important to be familiar with during International shipping. We are here to help you get started today.

What are the laws of Incoterms?

Who announces Incoterms rules?

How many types of Incoterms method?

Importance of Incoterms in international trade

What don't activities cover by Incoterms?

International commercial terms are also known as incoterms, an internationally recognized rule to define buyers' and sellers' responsibility. The incoterms rules are accepted by government and legal authorities all over the world for their international trade. It is also named tread terms or delivery terms. It defines who is responsible for paying the shipment, insurance documentation, customs clearance, and other necessary logistics shipments activities. It analyzes the task, risk, and cost for the buyers and sellers in their international trade. In a word, incoterms are a series of predefined commercial terms. These predefined commercial terms are expressed in a code. Every code of incoterms consists of 3 alphabets. This method of incoterms helps you find the best guide for your shipping.

What are the laws of incoterms?

After knowing that, what is an incoterm we help you to know about the unique features or laws of incoterms. It will give you a clear idea about incoterms. We can learn quickly from here why one should purchase incoterms? Let’s see:

- Incoterms related only sales agreement, not selling price.

- It's not like a patent method, and ownership transfer of incoterms isn't possible.

- It can use for both international and local markets.

- Every rule of incoterms represents three words, and the first alphabet of each word makes a unique code for international trade.

- These code words represent all of the information in your international trade. It’s helped a buyer and seller to reduce sales agreement.

- Provide a clear idea about buyer and seller obligations.

- No misrepresentation.

Who announces incoterms rules?

The international chamber of commerce (ICC) announced the Incoterms rules. In 1936, the international chamber of commerce published incoterms rules for international trade. It helps both buyer and seller to reduce sales agreement and makes International trade easier for everyone. It clarifies the exporter's responsibility, and the importer gets a good idea about the exporter’s responsibility or vice versa. It updated in 2010 for the last time, and it’s working from the first January of 2011. INCOTERMS is a registered trademark of the international chamber of commerce (ICC).

How many types of incoterms method?

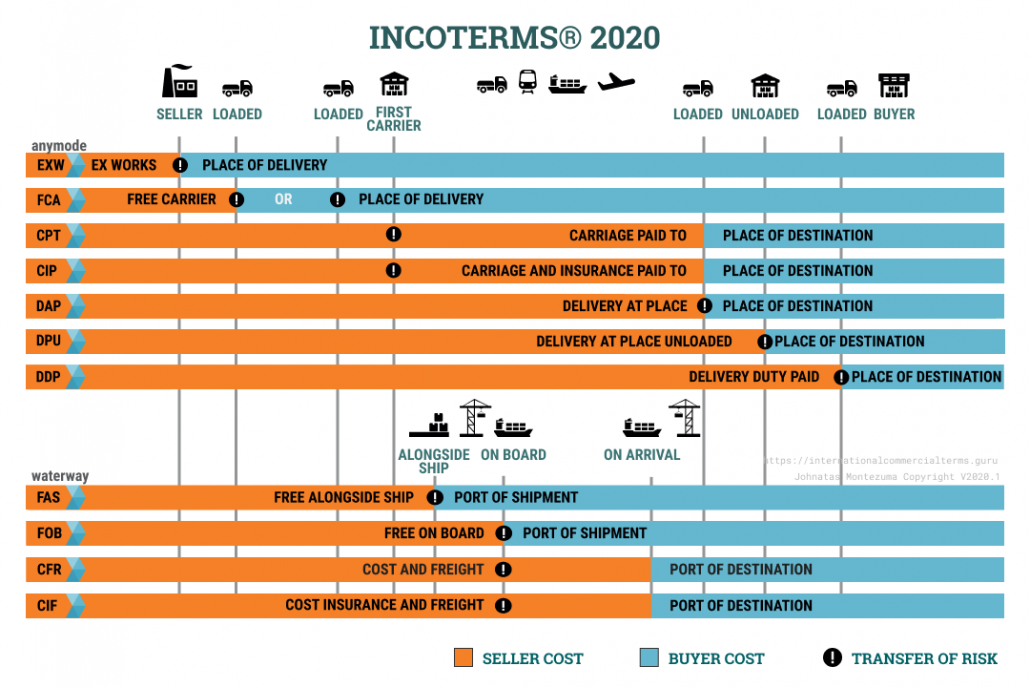

The international chamber of commerce announced 11 types of incoterms method. These methods help you to find the best way for your shipments.

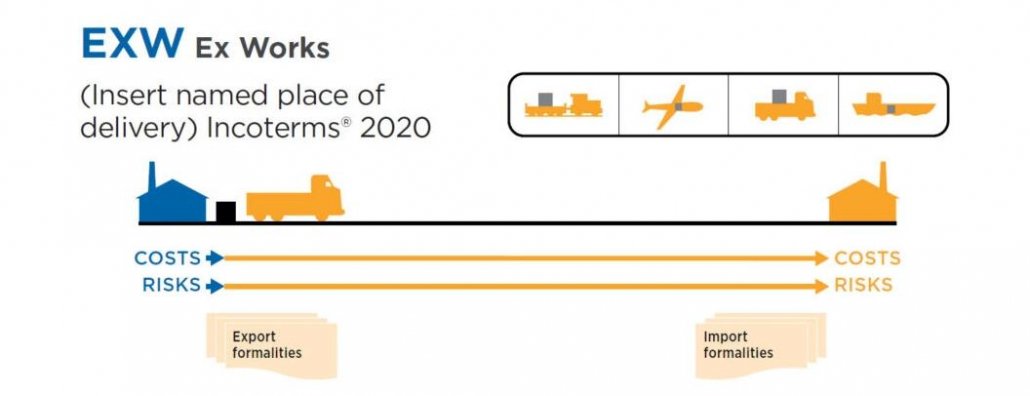

- EXW - Ex Works (implant place of delivery). Under this method, the buyer takes all of the responsibility like shipping and regulatory of goods from the origin of the seller location.

- FCA - Free Carrier (implant named place of delivery). Seller of goods is responsible for delivering those goods to the buyer's destination or his nominated place.

- CPT - Carriage Paid to (implant place of destination). The seller delivers the goods at their expense to a carrier or another person selected by the seller. In this state, the seller took all the responsibility.

- CIP - Carriage and Insurance Paid To (implant place of destination). Under this method, the seller is responsible for paying all the freight and insurance costs at the buyer's destination.

- DAP - Delivered at Place (implant named place of destination). The seller is responsible for delivering the goods to the buyer's goal, and also, the seller needs to pay the freight cost.

- PDF - Delivered at Place Unloaded (implant of the place of destination). The seller is responsible for until disposal of the goods at the buyer's destination.

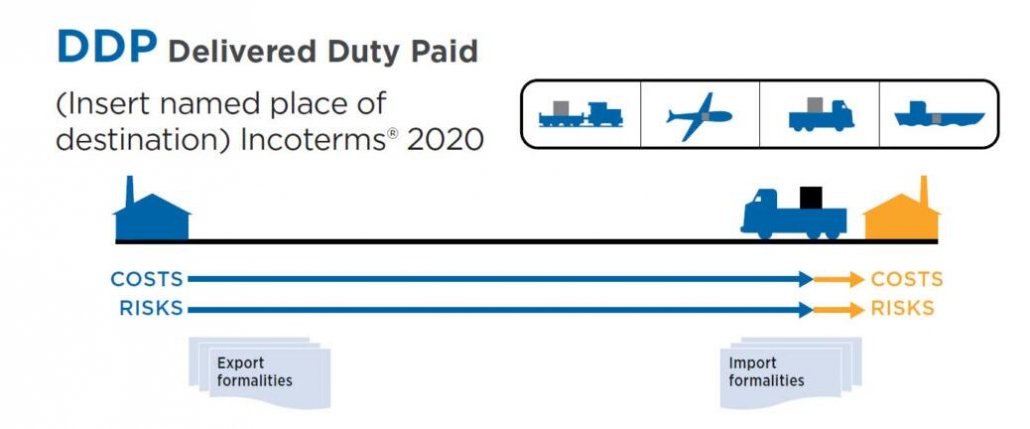

- DDP - Delivered Duty Paid (implant place of destination). Under this method, the seller is responsible for paying all the costs to the named place of destination. Here a buyer is free from charge and risk.

- FAS – Free Alongside Ship (implant name of the port of loading). Under this method, the seller is responsible for paying the cost until the freight on the vassal. After that, all the responsibility is handed over to the buyer.

- FOB – Free on Board (implant named port of loading). The seller took responsibility and cost before their goods arrived at ports. After lending goods, the buyer assumes all the blame.

- CFR – Cost and Freight (implant named port of destination). In this condition, the seller needs to pay for all the freight costs and is responsible for arranging necessary documents.

- CIF - Cost Insurance and Freight (implant named port of destination). Under this method, a seller is responsible for paying only freight and insurance cost. He is no more payable above that.

EXW, FCA, CPT, CIP, DAP, DPU, DDP are used in any modes of transportation on the opposite, FAS, CFR, CIF,FOB these incoterms are used only sea and inland waterways. So, you can’t use these incoterms method for shipping in railway or airline. Before your shipments, you need to follow these incoterms methods and chose one. It helps you to determine your responsibility when you are shipping goods.

Who can purchase incoterms?

If you are an import or exporter, you need to purchase an incoterms agreement for your international trade. That helps both of you by providing a clear idea about your responsibility. It has some obligations from the buyer and seller perspective. Let’s see:

The duty of a seller:

- Car and insurance agreement

- Supply goods

- Risk transfer

- Notice to the buyer

- Providing necessary documents

- checking, packaging, and marking the products.

The obligation of a buyer

- License

- Car and insurance agreement

- Receiving delivery

- Risk transfer

- Notice to the seller

- Proof of products received

- Inquiry of products

- Help to provide an overview of the cost.

So, if you purchased an incoterms agreement, you needed to follow this kind of obligation. Some of this obligation is same from both the buyer and seller perspective. So, before your agreement, you have to discuss with your corporate partner that it helps you ensure your responsibility. This obligation will help you to make a good sales agreement and reduce no misrepresentation.

Importance of incoterms in international trade

Simplify the negotiations involved in international commerce. Ensure common understanding of obligations.

So, we get a piece of adequate knowledge about incoterms. Now the question is why one needs to go for incoterms agreements?

- Reduce misrepresentations

- Risk reduction

- Reduce sales process and times

- Define responsibility

- We are managing logistical activities like insurance, customs clearance.

What don't activities cover by incoterms?

Incoterm is generally covered above activities. Let's see what not:

- Condition of sales.

- Identify only the goods that are for sell not list the contract price.

- Reduce the selling process, not price.

- Specify only documents, not collect them.

- Overall, incoterms provide an idea, not a solution.

So, we hope we can help you make clear about the word "INCOTERMS." If you are making international trade (import-export), incoterms rules allow you to reduce your business process. You will get a clear idea of your shipments. It helps you which incoterms method is perfect for you and will enable you to assume responsibility for your shipping. If you need more information, please contact us at info@dfhfreight.com. We are here 24/7 for your service.

Contact DFH Global Logistics for Best Rate

The Best Freight Forwarder in China